Innovation and value creation might be current management buzzwords... but they come with a huge dollop of reality bytes. While value to a customer is products & services that understand & satisfy his spoken & latent needs, value to employees translates into empowerment, motivation, rewards and recognition. Value to investors could be revenue growth, profit margins and market shares that offer high returns on their investment. Firms that are not taking a closer look at their value creation processes would do well to sit up and take notice. An insight…

Operating in the knowledge economy is distinctly different from the product economy as firms are finding out. Changes in technology, markets and regulation have made geographical boundaries more or less redundant. The good news is that firms have a wide and deep consumer pool to fight for. The only caveat being that firms need to constantly have their ear to the ground to create value for their consumers, shareholders, partners and employees. While many firms around the world are ostensibly engaged in the process of creating value, only a handful really have systems and processes in place for long-term value creation.

In other words, they all understand that they have to create value for customers, investors and employees. But these three sets of stakeholders are so linked that creating value for one in isolation would at best be a short-term victory.

Value creation process

Value to a customer is products and services that understand and satisfy his spoken and latent needs. Value to employees translates into empowerment, motivation, rewards and recognition. In other words, a work culture that is a worthy backdrop to his capabilities. Value to investors could be revenue growth, profit margins and market shares that offer them stable and high returns on their investment.

Firms, and their managers are more often than not pushed willy-nilly to promote shareholder wealth, even at the cost of the customer or the employee. In the long run, this results in alienating customers or losing employees to rival firms. The root of this problem is a win/lose or zero sum approach, where managers imagine a fixed bundle of value that has to be split between three sets of stakeholders. Evidently, one’s gain represents a loss for another.

In a flatter world, not only are consumers different (they are more informed, networked and empowered), but also firms have changed almost beyond recognition. They are more flexible (any and every part of the value chain can be outsourced, modified and/or relocated). This has spawned a new value creation process; that of co-creation S C K Prahalad and Venkatram Ramaswamy put it. A step forward from where firms decided what to produce and then sold it to the consumer.

In the new economy, consumers and firms together create value. With the concept of co-creation, Prahalad and Ramaswamy weave a compelling picture of an experience centric view of value creation where the product is nothing but a means of creating unique individual experiences.

Determining value creation processes and key requirements

Competition is no longer for slivers of a market. Instead it is for innovation and breakthroughs achieved through stakeholder participation. The keyword here is ‘participation’. Having established that shareholders and customers were not competing for a fixed value, it was possible to say that stakeholders could participate to create an ever-increasing value, for the benefit of all.

The 21st century is certainly challenging. There are many ways to creating value, and they are constantly changing. Value, itself seems to have a shelf life and that too a very short one. There is no formula or static strategy to plug and play; these processes differ from firm to firm. The only common thread being that they create value for all stakeholders over the long term. What is available is a quick checklist of dos to aid the design of value creating processes.

Approach to evaluating business decision: A business decision could look different if viewed from the different time horizon perspectives. Investment in employee training is a cost here and now, but represents a steady stream of revenue on. account of improved productivity in the longer term.

Perception of self-interest: Identify basic building blocks of value creation in your firm. They could be customers, employees, processes, technology or investors. Track the development of the key drivers to creation of value by creating strategic balance sheets for each of them. For instance, customer loyalty and satisfaction could be assets that can be tracked on the customer balance sheet. Interlinking these balance sheets will help managers break out of the financial measures-driven myopia.

Company-employee dynamics: Focus on creating opportunities for employees rather than minimising employee-related costs. The rationale - working with the customer to create value pre-empts its distribution to customers and investors.

Company-customer dynamics: Creating value for the customer often narrows down to two options. The first, which most firms head to, is cost cutting. This often leads to a win-lose situation with suppliers, channel partners and employees. Albeit it leads to a short term win for the firm. The second approach, which a few firms venture into and fewer succeed, is the approach to innovation and differentiation by focusing sharply on the customers’ needs, viewing it from different angles and innovating. This is a source of long-term value creation.

View of competition: This is at once a ‘do’ and a ‘do not’. Certainly, view competition as an important source to compare and determine if your firm has created superior value and differentiation for customers. But competition cannot be the beacon that tells the firm what the customer wants. That is solely to be done by the firm by its unique understanding of what the customer wants, how the process must be designed or the service be delivered. In other words, tracking competition is no excuse for focus slipping away from the customer.

Approach to customer value: Value to the customer would be a product that he finds useful over the long term. It could mean lower cost, better quality and better service. He may have an academic interest in your benchmarking efforts with competition (that your product is x% more durable, softer, sharper or cheaper than competition), but a very real concern to ensure that his needs are satisfied.

Tools and techniques

Value creating strategies can be grouped under the following themes:

- Developing win/win relationships with customers, suppliers, distributors and investors

- In depth understanding of different customer segments and their changing needs. Leveraging existing technology to create new markets

- Leveraging new technologies to create value in current markets

- Leveraging regulatory changes to create new customer segments or markets. Redesigning firm and sector value chains

- Product, service and process innovation.

Some of the popular tools and techniques used to develop value creating processes are:

Lean enterprise system: James Womack first used the term ‘lean manufacturing’ in his book ‘The Machine That Changed the World’. which is based on the Toyota Production System (TPS). The TPS is a model of the processes that helped Toyota catapult to the top of the automobile industry. Lean manufacturing helped firms make great strides in productivity and quality. As an extension of this concept, lean enterprises apply this model to the entire organisation to achieve overall productivity gains. Broadly speaking, the model works on reducing organisational flab by:

- Taking small bites, working on small lots of work to increase organisational flexibility

- Just in time (JIT) concepts applied to manufacturing both in house and externally, when sourcing through partners

- Reducing departmental silos, using a process related view rather than the more frequent function-based approach

- Integrate customer-oriented strategies, employee involvement efforts and management techniques to view the firm’s processes as a unique whole and eliminate wasteful activities

Lean enterprise systems add to customer value by helping firms operate at their highest level of efficiency at the lowest possible cost. It therefore involves cross-functional teams and individual employees developing and implementing continuous improvement ideas in all processes to make the firm a lean machine that is faster, cheaper and better.

Six Sigma: Six Sigma helps firms improve total business processes. It is not a solution that fixes processes that are broken. Instead, it is a continuous improvement programme with a well-defined place and role for everyone in the organisation.

Six Sigma first began with a focus on improvements in internal operations, targeting processes within a firm. However, it is not limited to production processes. It touches upon different aspects of business namely, sales and marketing, R&D and others. In other words, it helps firms strive for and achieve operational excellence.

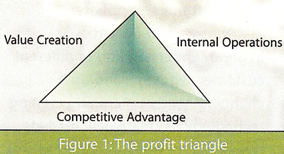

To explain the role of Six Sigma better, the profit triangle indicates three vital areas for any firm - internal operations, competitive advantage and lastly, value creation. All three aspects are interlinked and the firm’s approach and success on one front impacts that on the others. Six Sigma is highly structured and data-driven, and can support all sides of the profit triangle.

ISO 9000:2000 standards: The ISO standards are reviewed every five years to incorporate changes and meet the changing needs of the business landscape. The ISO 9000:2000 standards are different from the 20 original ISO 9000: 1994 elements in that they adopt a more process-oriented approach. Departing from the old focus on measurement and consistency, the new standard zeroes in on continuous improvement, effective communication and customer satisfaction. Experts offer the following advice to firms that seek this certification and achieve overall improvements:

- View the business from a process perspective

- Understand the business flow and map it as a process

- Feed in the different procedures that are currently in use

- Review the processes from a quality and lean enterprise perspective to eliminate waste

Industry best practices

Companies around the world are waking up to the fact that competition and market leadership will follow innovation and differentiation. Here are some firms that have made a habit of innovation.

The Tata Group has been a pioneer in implementing quality and continuous improvement initiatives. One of their successful endeavors is their ‘economic value added’. or EVA implementation. EVA, a financial measure the economic value added of a firm is defined as ROI (return on invested capital) less a charge for the cost of capital invested (weighted average cost of capital or WACC). It is a concept mooted by Stern Stewart and Co, USA. When Tata Sons, decided to embark on EVA valuations, there were reservations as people were used to the traditional stock measure of ROI. Simply put, EVA made the firm look less profitable. The trick was to make them understand that EVA was a flow measure and that the firm would create value if it set and adhered to targets for EVA improvement. To quote Homi Khusrokhan, managing director, Tata Tea, “The greatest benefit of EVA will be an improvement in the quality of decision making which sooner or later, translates into improved EVA”

Motorola is another firm that consistently creates customer and shareholder value. It introduced the Razr V3, the world’s slimmest mobile phone when it was all but beaten by Korean competitors. To create this success, Motorla’s management had to radically change the way its internal innovation processes functioned. In a departure from its complicated process where regional heads weighed in with their suggestions, the Razr development team was removed from the company's regular development process and given the freedom to develop the product they believed in.

For over 100 years, 3M’s formula for growth has been to hire the right people, create the right environment for them to work and then let them do their thing. This has resulted in more products and patents than any other firm. Such success can only be attributed to the firm’s commitment to innovation.

Conclusion

As speed enablers like information technology and telecommunication shorten time to market as well as shelf life of products, services and people, firms stand to gain if they develop long term, win-win relationships with employees, customers and investors based on mutual trust for mutual benefit. It is not simply an option; it is the only viable path to sustainable value creation.

CREDITS: Suresh Lulla, Founder & Mentor, Qimpro Consultants Pvt. Ltd.